2024: Nanuk Seminar: The out-performance from alignment with structural changes in the economy

Highlights from Nanuk’s 2024 seminar – Boiling Frogs – 3 mins

2024: Nanuk Seminar: capitalising on the global transition with a style-neutral approach

Highlights from Nanuk’s 2024 seminar – Boiling Frogs – 3 mins

2024: Nanuk Seminar: Investment Style Biases: 30 Years of Winners and Losers

Highlights from Nanuk’s 2024 seminar – Boiling Frogs – 8 mins

2024: Lonsec Chat – out-performance from alignment with structural changes in the economy

A discussion with Lonsec Research

2024: Boiling Frogs

Why investor apathy makes continued outperformance likely. October 2024 is likely to see the highest average global temperatures ever recorded. In fact, each month for the past 15 months has been the hottest on record. Yet it seems no-one, let alone equity market investors, is concerned. At some point, they will be. Meanwhile, amidst a […]

2023: Climate Moneyball

Recently we have witnessed a dramatic escalation in government support for sustainable technology as most of the world embraces 2050 net zero emissions targets. On the surface, it appears things are moving in the right direction and the winners have become clear to see. Experience makes us think differently….. EARN 1.50 CE/CPD HOURS FOR WATCHING […]

2022: Beyond Renewables, EVs and Hydrogen: What are the next big sustainability trends?

The last 20 years has seen a gradual acceptance of the necessity to decarbonise the economy and we are now clearly on a pathway to widespread adoption of renewable energy, energy storage, electric vehicles and hydrogen. However, even if these achieve universal acceptance in coming years they will only address around half of global greenhouse […]

2022: Summary: Climate Change Requires Offence and Defence, just not now

Tom King addresses the Portfolio Construction Markets Summit 2022: Regulation and policy to achieve global net zero targets will drive profound changes in the global economy in coming decades. The impacts are predictable and likely to be negative for equities markets over the medium to long term, driving long term returns below historical levels. In […]

2022: Full Video: Climate change requires offence and defence, just not now

Tom King addresses the Portfolio Construction Markets Summit 2022: Regulation and policy to achieve global net zero targets will drive profound changes in the global economy in coming decades. The impacts are predictable and likely to be negative for equities markets over the medium to long term, driving long term returns below historical levels. In […]

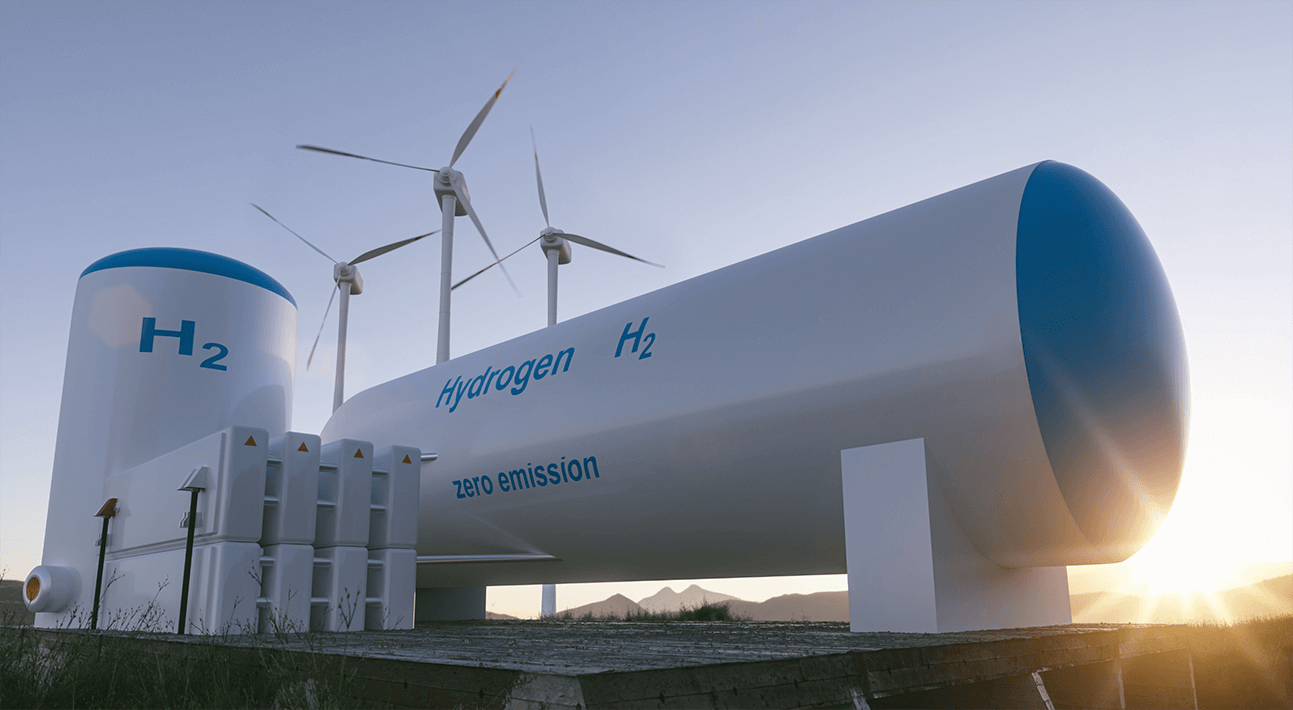

2022: Green hydrogen good for climate but tough investment

Interest in hydrogen has ballooned as the world looks for ways to solve the growing climate crisis and cut carbon emissions, but successful investing in this rapidly emerging sector requires a lot of deep industry analysis and the opportunities, while there, can be difficult to spot. That the sector has strong growth potential is not […]

2022: Plant-based meat – good eating but tougher investment

A soy-based marble steak fillet may make an appealing meal. It could also help reduce global greenhouse gases. But with a price of around $100 a kilo, it is an expensive experience for most people, highlighting one of the key issues with investment in this market. For alternative meat products to achieve widespread adoption by […]

2017: The Sustainability Revolution

The long awaited tipping point where unsubsidised sustainable technologies beat dirty industries is upon us. Nanuk sees enormous growth, along with misery and stranded assets for legacy technologies.

2017: Ethical Investment Week 2017

Nanuk for Ethical Investment Week 2017.

2018: Tom King Addresses The Capital Focused Seminar

Nanuk’s CIO Tom King OAM addresses the Capital Focused client seminar in May 2018. Our thanks to Capital Focused Financial Planning